The IRS: A Taxing Affair with an Irony Twist

Back in April 2021, I made a bold case for boosting IRS funding, citing two golden benefits: first, that it would pay for itself through an avalanche of tax revenue, thus letting the government achieve great things without resorting to the dreaded tax hikes. And second, it would allow the IRS to channel some love into customer service, transforming the agency from a villain in taxpayers’ stories to a somewhat bearable sidekick. But as always, good intentions are at the mercy of political theatrics.

Fast forward to today, and the funding increase officially passed with the Inflation Reduction Act. Cue the Republicans, who seem determined to make this their primary issue, because nothing says “fiscal responsibility” like complaining about the IRS getting a financial upgrade. You have to love how they can pivot from “let’s cut taxes for the rich” to “how dare we enhance tax enforcement?” So deliciously ironic.

On merit, it’s probably their weakest argument, but in terms of political impact, it’s the cherry on top of their complaint sundae. If you’re against spending hundreds of billions to subsidize zero-carbon energy, fine—many of us envision a world where trees can breathe easy. But opposing the government collecting taxes? Oh, that’s a delightful recipe for tax evasion. Talk about a party line that raises eyebrows.

Let’s rewind to the 2017 tax reform bill, which aimed to cut taxes but took a brief detour into revenue-boosting by curbing the SALT deduction. How tantalizing would it have been for the GOP to consider increased tax enforcement to keep the cash flowing? Instead, they seem to have developed a soft spot for tax cheats—perhaps a newfound hobby?

It’s fascinating how taxes, those mystical levies placed on economic categories, can be predicted. Yet, somehow, every country seems to report less revenue than those lofty estimates proclaim. It’s like having a friend who always overestimates their potential at karaoke night—nobody enjoys the off-key notes, which usually stem from the complexities of small business taxation. Spoiler alert: it’s not the cab driver slipping cash that knocks GDP off course.

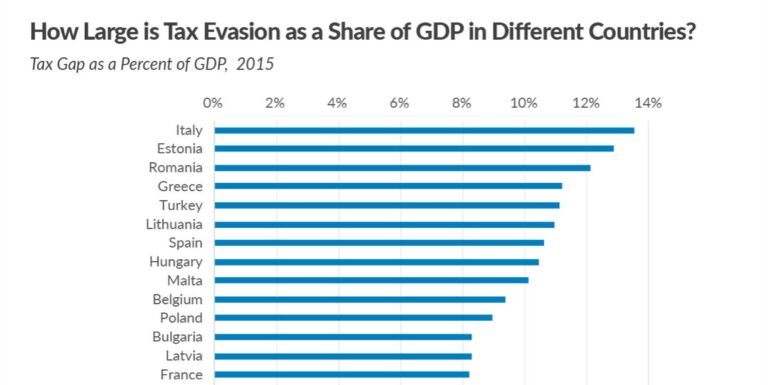

But fear not, dear readers! As the Tax Foundation’s report shows, the American tax gap isn’t as heinous as it seems—at least compared to our Mediterranean pals. Countries ripe with tax evaders aren’t exactly known for their booming economies. Take a peek at Italy and Greece, where small businesses thrive on a ‘what’s a tax, really?’ philosophy. These places function like dysfunctional sitcoms instead of vibrant economies. Is that really the model we want to emulate? Let’s aim for a world where compliance is so high that even our greenest chips are squeaky clean.

Let’s get real; the argument that increased IRS scrutiny will crush the average hardworking American is as valid as claiming that tax evaders are just ordinary folks. Regular people—those who earn their bread as employees or through pensions—are already paying up. The Tax Foundation makes it clear: the tax gap largely comes from self-reported income with fewer eyes watching, like business profits and income from rental properties. Fewer watchdogs, more potential for shenanigans.

As a small business owner, I can assure you that the essence of morality isn’t automatically tainted by self-employment. When it comes to taxes, the challenge is calculating income versus expenses, often leading to debates that are more metaphysical than your standard existential crisis. “Is this yoga class a business expense?” Spoiler: it’s not. But alas, without sufficient audits, the fewer ethical folks might find themselves veering into the murky waters of “creative bookkeeping.”

The Congressional Budget Office thinks that a cozy $80 billion injection into the IRS will yield about $200 billion in fresh tax revenue. That’s a tidy net gain, although it undercounts the potential upswing in compliance, as about a quarter of that stack is earmarked for customer service. Natasha Sarin, an economist who seems to know a thing or two, believes the jackpot could reach over $300 billion. Fingers crossed, right?

So there you have it, Republicans! Continue to rail against the Inflation Reduction Act and its myriad benefits while secretly wishing you had included tighter tax enforcement in your grand plans. When the next debate arises about slashing federal revenue, you have two choices: cut tax rates or embrace punishment for tax cheats. Choose wisely—unless you’d rather we spend more time discussing that nice little rapport so many seem to have with tax evasion!