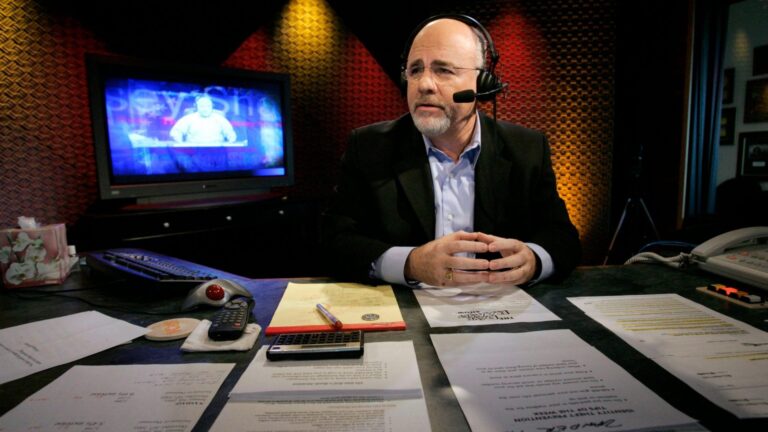

Mark Humphrey/AP/Shutterstock

Commitment to Informative Financial Guidance

At GOBankingRates, our editorial team is dedicated to providing unbiased reviews and insights. We employ data-driven methodologies to assess financial products and services, ensuring that our evaluations remain free from advertiser influence. You can learn more about our editorial standards and review methodologies.

Understanding Ramsey’s Approach to Debt and Retirement

While conventional financial advice advocates for consistent contributions to your 401(k)—especially if your employer matches—bestselling author Dave Ramsey offers a different perspective. He suggests that if you’re burdened by debt, the priority should be to eliminate that debt completely before considering retirement investments.

Why You Should Pause Your 401(k) Contributions

Ramsey’s controversial advice to stop all 401(k) contributions can be unsettling for many. He understands the appeal of a 100% employer match; however, he emphasizes the mental and financial advantages of eliminating debt first. By halting retirement contributions for around 18 months, you can focus on paying off debt quickly, allowing you to invest more effectively once you achieve debt freedom.

Step 1: Establish a Small Emergency Fund

Before tackling your debts, Ramsey recommends putting aside $1,000 for emergencies. This fund is crucial for handling smaller, unexpected expenses like car repairs or appliance malfunctions, preventing you from falling deeper into debt. Quick actions such as selling unused items or cutting discretionary spending can expedite this savings goal.

Step 2: Implement the Debt Snowball Method

Ramsey advocates for the Debt Snowball Method, which emphasizes behavioral changes over numerical calculations. Begin by listing your debts from smallest to largest, excluding your mortgage. Focus on making minimum payments on all debts while directing any surplus funds toward the smallest debt. Once that debt is cleared, reinvest the freed-up payment into the next smallest debt, creating a motivational momentum as you eliminate each liability in succession.

Step 3: Resume Retirement Investments After Achieving Debt Freedom

Debt freedom, according to Ramsey, means having no monthly payments except your mortgage. Only after clearing all non-mortgage debts should you reinvest in your 401(k) and other retirement plans. At this point, with your income no longer tied to debt repayments, you can invest with greater effectiveness, generally suggesting allocating 15% of your income towards retirement savings.

When This Strategy Makes the Most Sense

Ramsey’s method is particularly beneficial for those with high-interest debts, such as credit cards. If you find yourself overwhelmed by various financial demands, his structured approach simplifies the process of achieving financial stability. This plan can be especially useful for individuals with variable incomes, like self-employed workers, as it establishes a secure financial foundation before delving into investments.

Exploring Alternatives to Ramsey’s Approach

However, Ramsey’s strategy is not universally applicable. For individuals with low-interest debt and attractive 401(k) employer matching, it may be more advantageous to contribute to their retirement plan while managing debt payments. High earners benefiting from tax advantages of retirement contributions might also find value in balancing debt repayment with saving for retirement. Ultimately, the most effective strategy relies on honest assessments of personal financial discipline and capacity.

This HTML representation includes structured headings and ensures the article is SEO-optimized by naturally incorporating relevant keywords. The content is engaging, informative, and captures the essence of Dave Ramsey’s financial strategies while maintaining clarity and coherence.