By Wolf Richter for WOLF STREET

Ah, the S&P 500, where stocks take vacation but still clock in for work. What a week it’s been! If you had the audacity to go offline for five whole days, you’d come back thinking the market drama was a Netflix series, rolling credits and all. But in the grand theater of finance, the S&P 500 ended right where it started—cue the applause!

Now, let’s talk about the rollercoaster that began with the Nikkei diving 12% on Monday. Panic hit the U.S. markets like a surprise fire alarm at a nap convention, but thankfully, it fizzled out faster than a two-day-old soda. Overall for the week, the Russell 2000 small caps index fell 1.3%, while our beloved Magnificent 7—that ensemble cast including Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla—tripped and stumbled down only 0.9%. Kudos to Meta for carrying its weight with a 6.1% gain; the rest of the gang? Well, they’ve been hitting the gym but still can’t seem to lift any positive numbers without a personal trainer.

Despite all the drama, the S&P 500 wrapped up the week with a resounding “meh” at 5,344. Since its July 16 peak, it’s only dropped 5.7%. That’s right, folks, it’s still basking in a 12% glow for the year. Who said stocks can’t party like it’s 1999? They can, but only if they leave their inflated egos at the door.

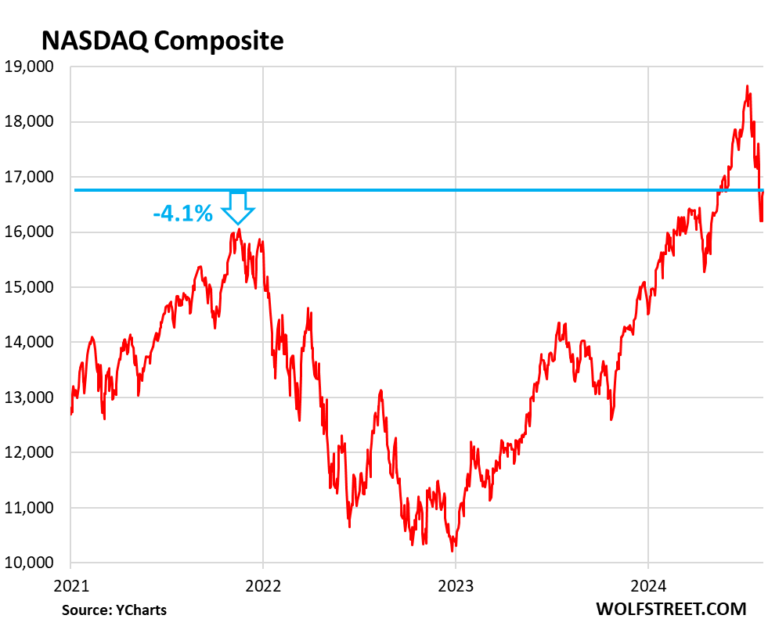

Let’s not forget about the Nasdaq Composite, which graciously declined by a mere 0.2% to close at 16,745. It’s down 9.5% from its peak on July 10, a real performer. But hold on a second! Should it fall 4.1% more, it’ll be celebrating its return to November 2021 levels, which means a playdate with a 36% drop and an 81% rise—an emotional rollercoaster that could make even the strongest among us dizzy. How’s that for market volatility?

The Russell 2000—the underdog that could—not quite. It’s been weighed down like a kid in a candy store who ate too many sweets. This index is still reeling from the mass implosion of stocks that once thrived in the pandemic. IPOs and SPACs came onto the scene like rock stars, only to crash faster than a one-hit wonder. Many of these would-be market darlings are tapping out with drops of over 80%, leaving the Russell stuck in a time warp back to early January 2021. For the week, it was down 1.3%, proving that even small caps can’t dodge the brutal realities of market life.

Meanwhile, the Magnificent 7 is experiencing a case of mistaken identity. Despite Meta flexing those 6.1% gains, the group as a whole is still down by a staggering $2.34 trillion since July 10. I mean, talk about a collective hangover that leaves us questioning our life choices! The fact that this massive hit only puts them back a few months merely underscores the sheer absurdity of market dynamics fueled by the current AI bubble.

And speaking of obsessions, let’s focus on Nvidia. Once hailed as the biblical ‘Most Valuable Company’—now reduced to a mere shadow of its former self, down a whopping 22.3%. It’s fascinating to wonder what happens if they mumble something about “lumpy” demand. Remember what happened to Cisco after a similar observation? Spoiler alert: it plummeted to $183 billion from its once-glorious multi-trillion-dollar aspirations. Got popcorn?

Finally, we arrive at Tesla, which boasts a remarkable return of—you guessed it—zero since December 2020. A staggering 51.7% drop from its peak in November 2021, and for the week? A dull 3.7% slide into the abyss. That tiny uptick over a few days? Invisible. Just like my hopes for a functional economic model.

If you enjoyed this winding journey through the mind-boggling world of stock fluctuations and market cap gymnastics, consider supporting WOLF STREET. Click the beer and iced-tea mug, because even financial news deserves a chill drink now and then. And hey, don’t miss our engaging updates—sign up here for your weekly dose of financial reality, delivered right into your inbox!

Source: Wolfstreet.com

Take the Survey at https://survey.energynewsbeat.com/

1031 Exchange E-Book

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack