Meet Mia McGrath: The 24-Year-Old Saving for Financial Independence

Mia McGrath, a 24-year-old British account manager, is a shining example of the Financial Independence, Retire Early (FIRE) movement. With a unique approach to budgeting, she saves between 50% and 70% of her salary, accumulating almost US$100,000 before reaching 25. Her ambition? To achieve financial freedom by the age of 40, targeting approximately US$1.3 million.

Background and Influences

Adopted from China, McGrath’s life experiences have fostered a strong sense of independence. She aims to build her financial security without depending on others. With a growing social media presence, including nearly 250 followers on TikTok, she has become an influential voice for young adults interested in the FIRE philosophy.

The FIRE Movement: Principles to Live By

The FIRE movement advocates for saving aggressively—anywhere from 50% to 75% of one’s income—during youth. The aim is to retire decades earlier than traditional norms. Central to this movement is the concept of compound interest; the earlier one invests, the more time their money has to grow. McGrath’s “FIRE number” is between US$1.3 million and US$1.5 million, allowing her to live off investment income.

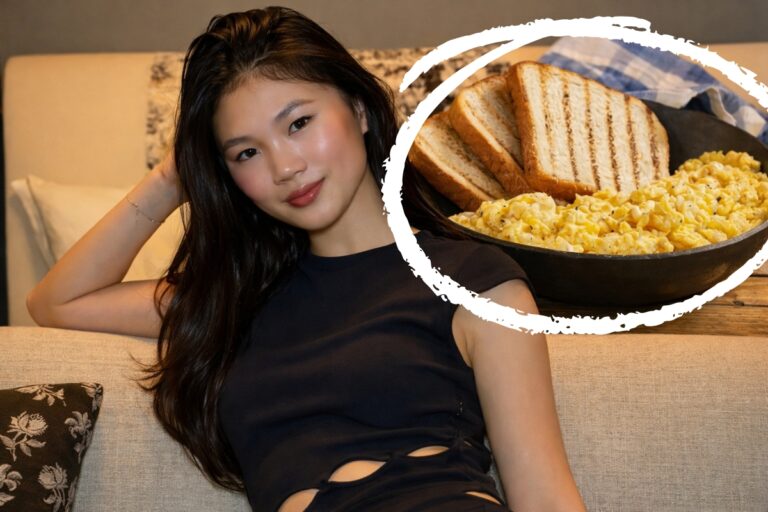

Frugal Living: Breakfast and Beyond

One of the viral details from McGrath’s financial journey is her $0.65 breakfast, consisting of homemade coffee, scrambled eggs, and toast. Yet, her frugality extends far beyond breakfast. Her comprehensive strategy includes living with her parents to eliminate rent costs, cooking all meals at home, and avoiding unnecessary luxury purchases, such as fast fashion.

Tracking Financial Growth

As her story has gained traction, McGrath’s financial situation has evolved. Starting with an estimated US$90,000 in savings, her total is now approaching US$97,000, boosted by her disciplined saving and investing habits. She aspires to reach US$180,000 in the coming years, maintaining an aggressive savings strategy.

Frugal Chic: A Balanced Philosophy

McGrath emphasizes that being frugal doesn’t equate to deprivation. Her philosophy, dubbed “Frugal Chic,” encourages intentional spending. Before any purchase, she evaluates the cost per use, maintenance effort, space occupied, environmental impact, and whether it would require working extra hours to afford it. By doing so, she frames luxury not just in monetary terms but also in the time it takes to earn it.

Debate and Critique: A Generational Divide

The financial discipline showcased by McGrath has sparked significant discussions online. Critics argue that trading youth for future savings may not be worth it, emphasizing the importance of living in the present. Concerns have also been raised about the potential health risks associated with early retirement and a less active lifestyle. McGrath, however, counters these critiques by stressing her goal of achieving a “soft retirement”—working less while still engaging in meaningful projects without the threat of financial instability.

Conclusion: Life Lessons and Future Aspirations

Mia McGrath’s journey transcends mere numbers and savings tips. She challenges us to rethink our relationship with money and consider our long-term goals. Her guiding question—“Does this bring me closer to, or further away from, the life I want to live in 10 or 20 years?”—encapsulates her approach. Ultimately, her story encourages individuals to reflect on what they are willing to sacrifice today for a wealthier, freer tomorrow.