In recent years, numerous articles have highlighted the financial struggles faced by Millennials, particularly regarding student loan debt, homeownership, and family planning. As the economic landscape continues to evolve, it seems that the challenges are now being passed down to Generation Z, who are also grappling with significant financial burdens.

Financial Struggles of Gen Z Workers

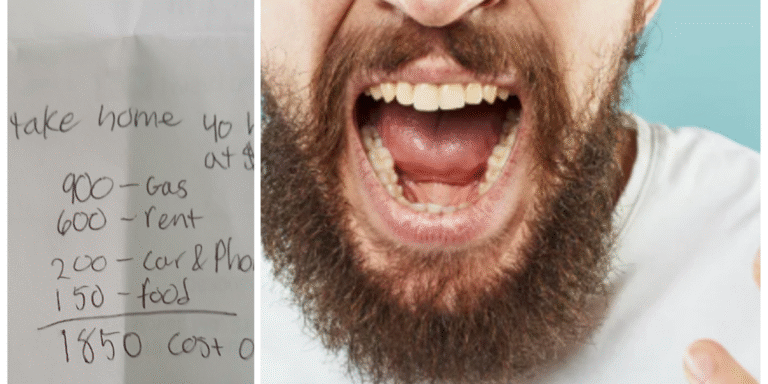

A current post on Reddit has drawn widespread attention, illustrating the financial challenges of a full-time Gen Z employee living at home with their parents. This worker, earning $16 per hour, meticulously broke down their monthly income and expenses. After accounting for essential expenditures like gas (which includes fuel for family trips), rent, groceries, car payments, and phone bills, they reported a mere $96 in monthly savings. This small cushion is precarious, as any unexpected expense, such as car repairs, could wipe it out completely.

Parental Support and Future Concerns

The Reddit user revealed that their parents have set a deadline of six months for them to find independent housing. Even a potential raise they might receive after four months would only increase their hourly wage by one dollar. The individual expressed frustration, stating that working more hours isn’t a feasible solution to their financial issues.

Reactions from the Online Community

The Reddit thread prompted numerous responses from others who shared similar grievances. Many commenters questioned how anyone could sustain a livelihood on $16 an hour when inflation has drastically inflated costs. Some pointed out that in states where the minimum wage still hovers around $7.25, the plight is even more severe.

Rising Cost of Living vs. Stagnant Wages

The increasing cost of living has emerged as a significant concern for young adults. Many commenters highlighted the disparity between wages and the rising costs of necessities, indicating it feels impossible to keep up financially. Even advice offered to seek jobs closer to home or look for better budgeting strategies doesn’t address the fundamental issue: wages simply aren’t keeping pace with living costs.

The Impact of Minimum Wage Policies

To better understand the gravity of these financial struggles, the Massachusetts Institute of Technology (MIT) provides an insightful living wage calculator. For example, Iowa’s minimum wage remains set at $7.25 per hour, yet a single adult living there needs to earn around $20.89 per hour to cover basic expenses. Meanwhile, in Washington D.C.—where the minimum wage reaches $17.50—a livable wage is estimated at $25.98 an hour. These figures clearly illustrate the disconnect between minimum wage rates and the actual cost of living.

The Purpose of Minimum Wage

It’s essential to recognize that the minimum wage was originally designed to provide adult workers with adequate purchasing power to participate in the economy, not merely as an entry-point salary for teenagers. This intent was to safeguard against employer exploitation, yet, as evidenced by the experiences of both Millennials and Gen Z, even a wage of $16 per hour falls short in today’s economy.

Looking Ahead: The Future of Generational Solidarity

As both Millennials and Gen Z continue to navigate these financial hurdles, there is hope that their collective experiences will foster solidarity. By advocating for economic policy changes and engaging in collective action, these generations might instigate the necessary reforms to create a more equitable financial landscape for everyone.

This article originally appeared in March.