The Complex Nature of Financial Gifts

When it comes to receiving financial gifts from friends and family, the implications can range from genuine support to complicated emotional entanglements. Determining your response to such gifts can be challenging, especially when expectations are involved.

A Real-Life Dilemma

In a recent episode of “The Ramsey Show,” finance expert Dave Ramsey addressed a caller whose grandmother gifted him and his wife $9,000. This money was intended for their wedding or a future home. The grandmother clearly stated that she didn’t expect repayment.

Change of Heart

Over time, however, the grandmother started probing into the couple’s financial situation, which made the caller uneasy. Ultimately, she requested repayment of the original gift, now with interest, totaling approximately $12,000. For the caller, with a household income around $70,000 after taxes, such a demand added significant stress.

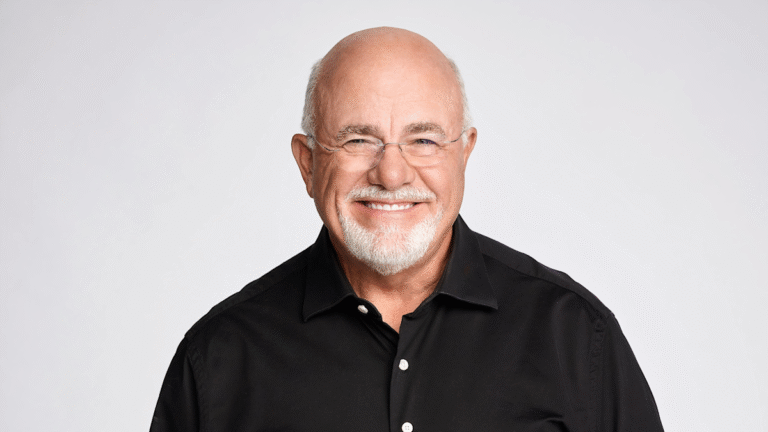

Dave Ramsey’s Guidance

Dave Ramsey firmly supported the caller, stating that he had no moral obligation to repay the money. He suggested reminding the grandmother of her original statement that the funds were a gift. However, he also acknowledged the emotional risks involved, warning that the grandmother might react negatively, causing family tensions.

Choosing Peace Over Principle

Understanding the potential for family discord, Ramsey advised a more pragmatic approach: consider repaying the grandmother, despite it not being the initial agreement. He encouraged the caller to weigh his options, including creating a payment plan that aligns with their financial ability.

Best Practices for Managing Gift Situations

If the caller decided to repay, Ramsey recommended doing so as swiftly as possible, while remaining alert to ongoing manipulations. He cautioned that if they paid the interest, the grandmother might continue to seek additional compensation, which could complicate their relationship further.

Final Thoughts and Recommendations

The key takeaways from this situation include the importance of establishing boundaries and understanding the nature of financial gifts. If faced with similar circumstances, consider the following options:

- Communicate clearly with the person about your decision and prepare for potential fallout.

- Repay only the amount originally given, either as a lump sum or through a payment plan.

- If necessary, explore mediation with a neutral third party or consult a financial therapist.

- Document any agreements in writing to avoid future misunderstandings.

Ultimately, it’s crucial to protect your emotional well-being and financial health when navigating the complexities of financial gifts. Ensure that all agreements are documented and witnessed to prevent further complications.