President Donald Trump’s new second term has quickly highlighted several trends, particularly regarding fiscal policy. The administration shows little interest in preserving traditional government spending, with significant cuts anticipated across various federal sectors.

Among the areas facing budget reductions is healthcare funding, a critical aspect of government expenditure long considered a political “third rail.” The Trump Administration has already started decreasing allocations to various academic research institutions and government agencies, further complicating the economic landscape with uncertainties in trade and tariff policies.

Despite these budget cuts and rising market instability, some analysts see promising investment opportunities in the life sciences sector. Notably, Scotiabank analyst Sung Ji Nam identifies attractive entry points within the industry, particularly among large-cap life science tool companies.

“With large-cap life science tools (LST-13) trading near a ten-year trough in forward P/E ratios, we believe that the worst-case scenario is already priced into valuations,” Nam observes. “Long-term fundamentals remain solid, and we anticipate growth acceleration into 2026 and beyond, suggesting further upside potential for the sector over the next year.”

Danaher Corporation (DHR): A Strong Contender

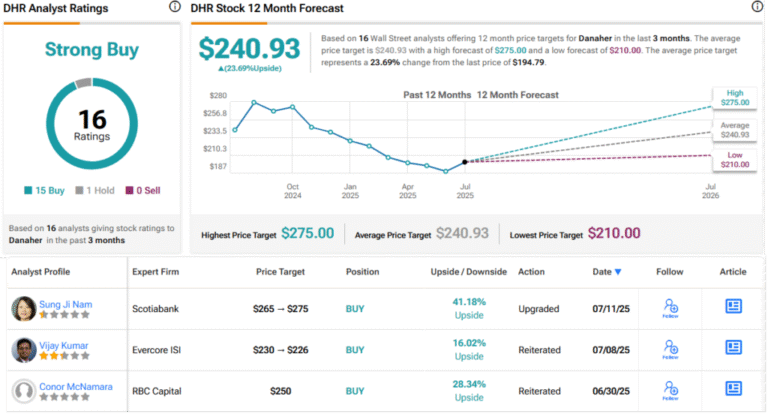

One of Nam’s top stock picks is Danaher Corporation, a leader in applying science and technology to human health. With a market capitalization of $138 billion, Danaher has recently faced challenges, including a 20% decline in its stock price over the past year.

Danaher operates through three primary divisions: biotechnology, diagnostics, and life sciences. The biotechnology segment supports therapeutic developers by expediting the commercialization of new medications. The diagnostics division focuses on creating tools for faster and more accurate medical investigations, while the life sciences segment encompasses cutting-edge techniques like fluid filtration and molecular oncology.

Financial Performance and Analyst Outlook

In its recent earnings report for Q1 2025, Danaher posted revenues of $5.74 billion, slightly declining but exceeding expectations by $150 million. Furthermore, despite reporting a decrease in non-GAAP EPS to $1.88, the results still beat forecasts by 24 cents. Overall, Danaher maintained robust free cash flow, exceeding $1 billion.

Nam emphasizes Danaher’s strong position in its niche market, anticipating an acceleration in growth over the next 12-18 months due to favorable exposure to later-stage development and diagnostics spending. She projects a price target of $275, indicating a potential upside of 41% within the next year.

Thermo Fisher Scientific (TMO): Another Top Pick

Another noteworthy stock is Thermo Fisher Scientific, a major player in medtech, producing essential supplies and equipment for research laboratories. Despite a 21% decline in stock price over the past year, the company boasts a market cap of $157 billion and reported total revenues of $42.9 billion last year.

Thermo Fisher operates through several divisions, with the largest being laboratory products and biopharma services. This segment significantly contributes to clinical research and development, while the life sciences solutions division adds nearly $10 billion in annual revenue, catering to bioproduction and clinical markets.

Future Potential and Investment Rating

In its Q1 2025 report, Thermo Fisher reported revenues of $10.36 billion, surpassing expectations by $130 million, with non-GAAP earnings of $5.15 per share. Notably, the company’s free cash flow remained strong at $373 million, despite a year-over-year decline.

Nam remarks on Thermo Fisher’s operational scale and innovation, asserting the company’s readiness to accelerate growth as uncertainty regarding U.S. healthcare policies settles. With a price target of $590, she foresees a potential gain of 39% in the upcoming months.

Overall, both Danaher and Thermo Fisher are positioned favorably in their sectors, with strong Buy consensus ratings from analysts, suggesting substantial growth potential. As investors navigate a tightening fiscal landscape, these life science companies may offer promising opportunities.

Disclaimer: The insights expressed in this article reflect the opinions of the featured analysts. Readers are encouraged to conduct their analyses before making investment decisions.