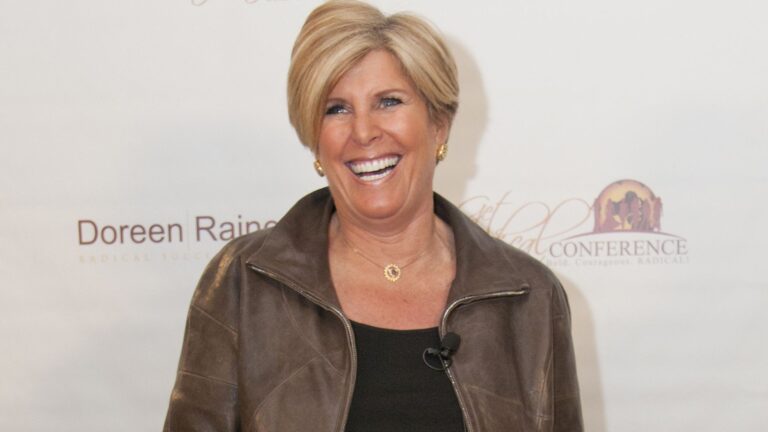

Patsy Lynch / Shutterstock.com

Commitment to Our Readers

GOBankingRates’ editorial team is dedicated to providing unbiased reviews and insights. Our rigorous, data-driven methodologies evaluate financial products and services, ensuring our reviews and ratings remain untainted by advertisers. Discover more about our editorial guidelines and review methodologies.

20 Years

Helping You Live Richer

Expert Reviews

From Financial Professionals

Trusted by

Millions of Readers

Understanding when and how you can retire doesn’t require a crystal ball, but it can often feel that way. Many people suspect flaws in their retirement plans yet are unsure how to identify or rectify them. In this landscape, consulting an expert like Suze Orman can provide invaluable insight.

Every day, countless individuals seek Orman’s guidance through her bestselling books, popular podcast, and television shows focusing on retirement planning. She highlights common pitfalls that could threaten your financial security in retirement, and crucially, provides actionable solutions to overcome these obstacles.

Recognizing Early Retirement Missteps

While dreaming of an early retirement may seem appealing, Orman cautions against structuring your entire plan around this desire. In her view, the Financial Independence, Retire Early (FIRE) movement often leads people to grossly underestimate their life expectancy and necessary savings. Making critical financial decisions prematurely can jeopardize your nest egg, especially if facing unexpected expenses.

Strategies for a Secure Retirement

To enhance your retirement prospects, Orman advises delaying retirement as long as possible. This strategy can maximize Social Security benefits and provide additional time for your savings to accrue. Moreover, remaining in the workforce allows you to allocate funds toward other vital financial goals, such as an emergency fund or debt repayment.

Addressing Healthcare Costs in Retirement

Many individuals neglect to consider potential healthcare expenses in their retirement planning. Orman emphasizes that Medicare does not cover all costs, leaving retirees exposed to significant out-of-pocket expenses. Implementing a comprehensive understanding of Medicare and getting a supplemental Medigap insurance policy can protect against unexpected medical bills.

Avoiding Overdependence on Market Performance

While retirement accounts like 401(k)s and IRAs are essential, Orman warns against basing your entire retirement strategy solely on market-dependent accounts. Market volatility poses risks; thus, maintaining cash reserves equivalent to three to five years of living expenses can help weather downturns, ensuring that essential expenditures remain covered.

By proactively addressing these areas, individuals can strengthen their retirement plans and navigate potential financial pitfalls with confidence. With foresight and planning, you can pave the way for a secure and enjoyable retirement.